Forex trading is a lucrative and exciting way to make money, but it can also be risky. To be successful in the Forex market, traders need to understand the basics of the market, the different types of trading strategies, the risks involved, and the tools available to help them make informed decisions. Gisterz Media will discuss what every Forex FX-market trader needs to know in order to be successful.

What is the Forex Market?

The Forex market is a global decentralized market for trading currencies. It is the largest financial market in the world, with an average daily trading volume of over $5 trillion. In the Forex market, traders buy and sell different currencies in order to make a profit. The prices of currencies are determined by supply and demand, and traders can take advantage of price movements to make a profit.

Different Types of Trading Strategies

There are many different types of trading strategies that can be used in the Forex market. Some of the most popular strategies include scalping, day trading, swing trading, and position trading. Each strategy has its own advantages and disadvantages, so it is important for traders to understand the different strategies and choose the one that best suits their goals and risk tolerance.

Risks Involved in Forex Trading

Forex trading carries a high level of risk, and it is important for traders to understand the risks involved before they start trading. The most common risks include leverage risk, market risk, liquidity risk, and counterparty risk. It is important for traders to understand these risks and take steps to manage them.

Tools Available to Help Traders

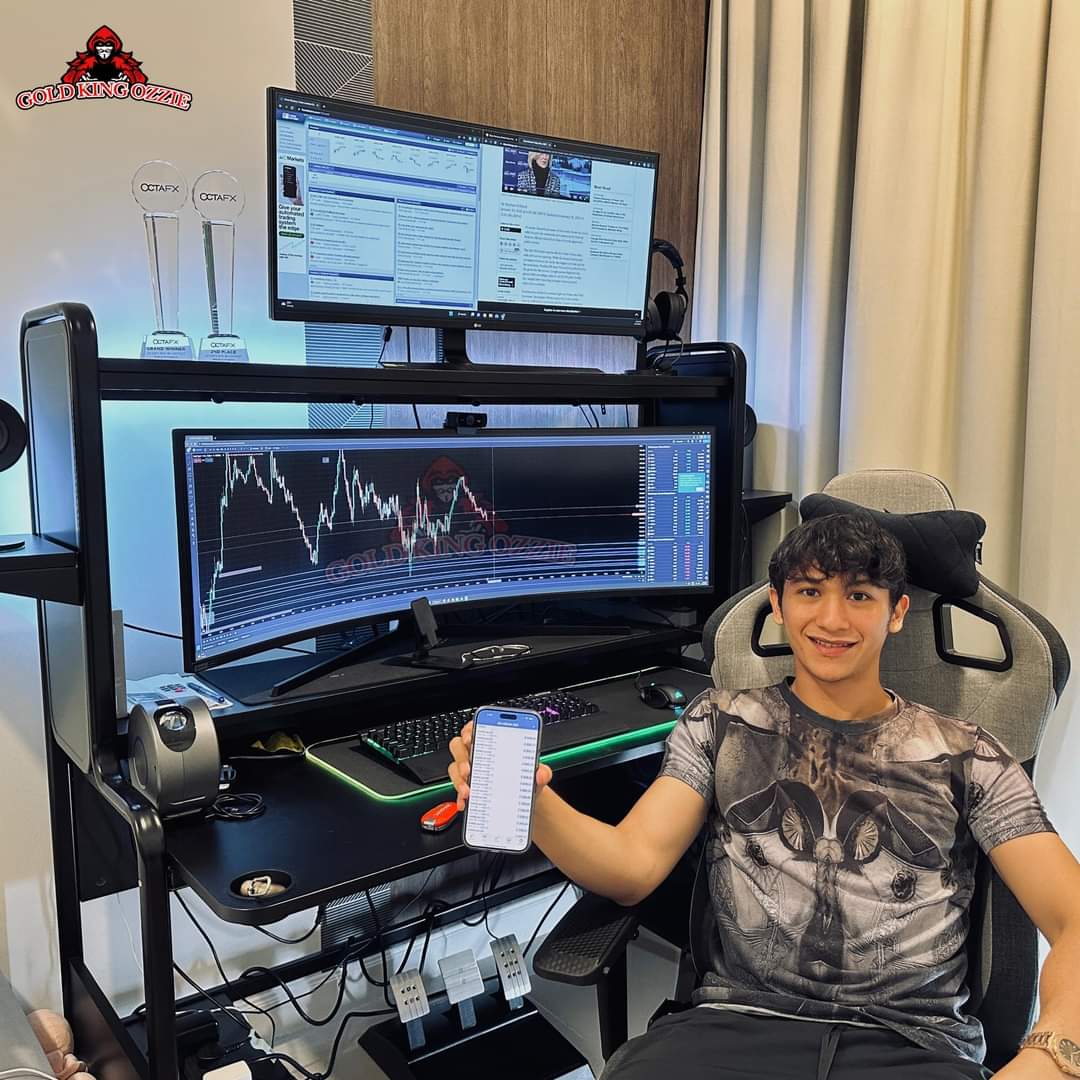

There are many tools available to help traders make informed decisions in the Forex market. These tools include technical analysis tools, fundamental analysis tools, risk management tools, and trading platforms. It is important for traders to understand how these tools work and how they can be used to make better trading decisions.

Understanding Market Conditions

In order to be successful in the Forex market, traders need to understand the current market conditions. This includes understanding the economic conditions of the countries whose currencies are being traded, as well as understanding the political and geopolitical events that could affect currency prices. It is important for traders to stay up-to-date on these factors in order to make informed decisions.

Developing a Trading Plan

Having a well-defined trading plan is essential for success in the Forex market. A trading plan should include a risk management strategy, entry and exit points, and a strategy for managing losses. It is important for traders to develop a plan that fits their goals and risk tolerance.

In conclusion, there are many things that every Forex FX-market trader needs to know in order to be successful. This includes understanding the basics of the market, different types of trading strategies, the risks involved, and the tools available to help them make informed decisions. Additionally, traders need to stay up-to-date on market conditions and develop a well-defined trading plan that fits their goals and risk tolerance. With this knowledge and understanding, traders can be successful in the Forex market.